Best Broker for Forex Trading in Philippines

Want to jump straight to the answer? The best forex broker for most people is definitely FOREX.com or CedarFX.

The Philippines benefits from having an emerging nation status as a Southeast Asian country. It also has a growing number of people interested in trading currencies, so quite a few online brokers will now accept clients from the country.

If you're based in the Philippines and would like to trade forex, you should know that the Philippines' Securities and Exchange Commission (SEC) has taken a rather adversarial stance against forex trading due to reports of fraud and heavy losses by retail traders. In fact, the SEC has issued 2 advisories in recent years stating forex trading is illegal to discourage private individuals from trading currencies and local brokers from engaging in the forex business.

Forex trading may not be strictly legal in the Philippines, so you probably can't find a local broker that will let you trade currencies. Despite that, you might still find an international online broker based outside the Philippines to trade forex.

Get Started with Forex in the Philippines

Getting started trading currencies in the forex market is relatively easy, although adverse regulations in the Philippines make things a bit more complicated for residents of that country. Here's the basic set of steps you'll need to take to make an initial forex trade:

- Step 1: Use a device that offers you Internet access.

- Step 2: Find an online forex broker that is licensed to operate in the Philippines.

- Step 3: Fund the account.

- Step 4: Open a margin account and make a deposit.

- Step 5: Download a forex trading platform with which that broker connects.

- Step 6: Make your trades.

The Philippines Forex Trading Strategies

Once you go through the 6 steps outlined in the previous section, you will have a funded margin account with a broker that allows you to trade forex from the Philippines. You'll probably want to develop a trading strategy to incorporate into your trading plan to increase your chances of success.

You can find 5 popular trading strategies listed below that can be suitable for retail traders no matter whether they are trading from the Philippines or elsewhere in the world.

- Scalping: Trading at a high volume and very short-term that involves entering and exiting the market quickly to capture a few pips at a time. You can repeat this process several times a day if you choose.

- Day trading: Entering and exiting transactions during a single trading session to avoid the extra risk involved in taking overnight positions. Trading decisions are often based on technical analysis, and you must understand historical trends if you wish to make informed decisions.

- News trading: Using strategies that take advantage of the extreme exchange rate volatility that occurs shortly after the release of important news or economic data. Current events often drive currency prices, and you must know what is happening minute-to-minute while trading.

- Swing trading: Entering and exiting the market usually based on momentum technical indicators with the general objective of buying low and selling high. Swing traders can also take positions overnight with the expectation that their position will improve when the market opens.

- Trend trading: Involving a longer-term strategy that looks for established directional movements called trends and then trading along with them until the trend concludes. In these cases, you are trading for the future.

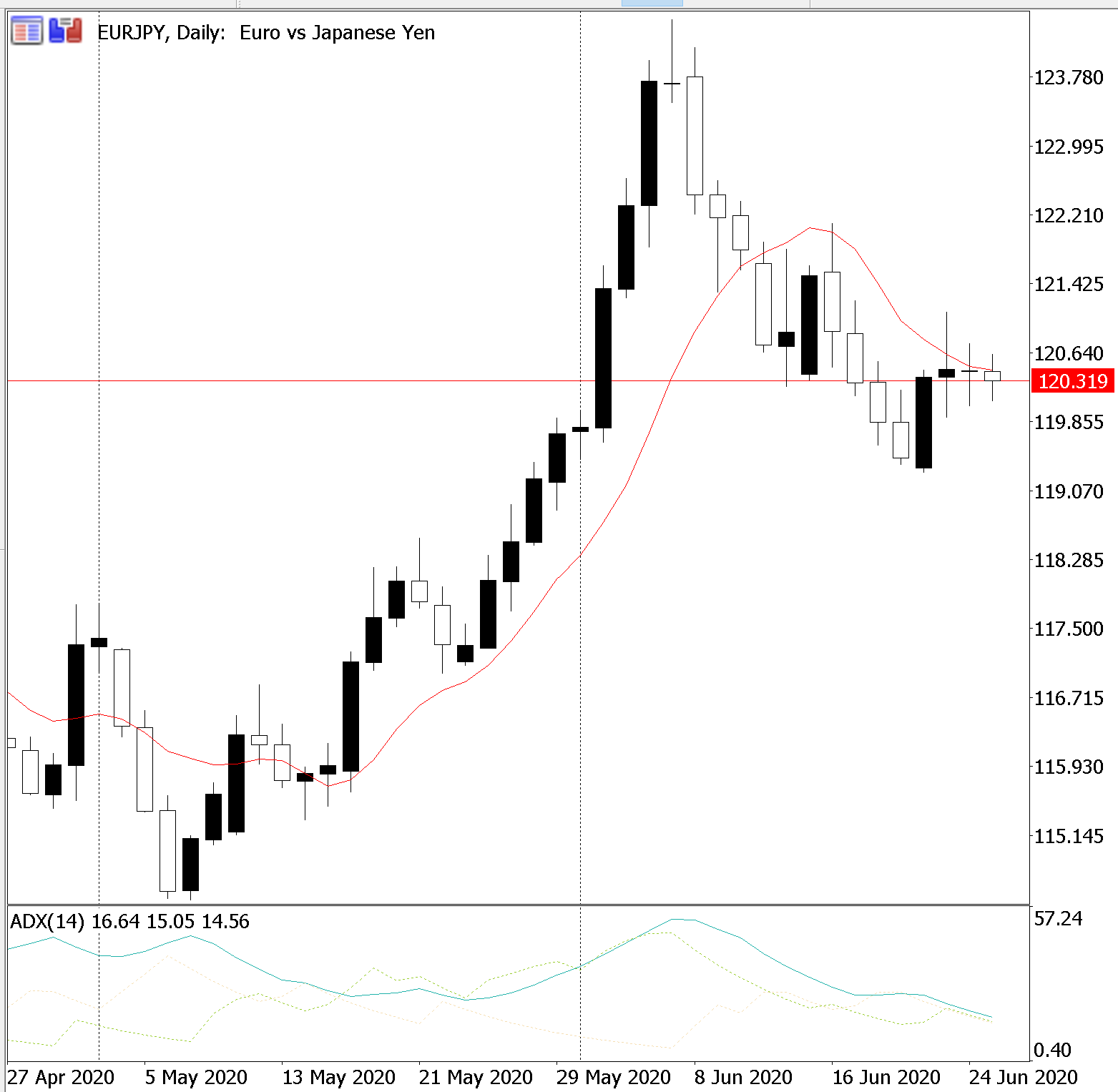

An upward trend in the EUR/JPY currency pair from 114.41 to 124.43 that a trend trader could have profited from. The daily candlestick chart also shows the 10-day moving average and 14-day ADX trend indicators. Source: MetaTrader .

Forex Trading Example in the Philippines

The national currency of the Philippines is the Philippine peso or piso (ISO: PHP). It has the symbol ₱ and ranks 30th in turnover within the forex market among the currencies of the world in April 2019, according to the Bank for International Settlements (BIS). A current quote for the USD/PHP exchange rate is 50 pesos to 1 U.S. dollar.

If you thought the USD/PHP rate was going to rise from its current level, then you might purchase $100,000 against the Philippine peso today at that exchange rate of 50.00. If the USD/PHP rate then subsequently rose to 51.00, you would use the following calculation to determine your trading gains:

100,000 USD x (51.00-50.00 PHP/USD) = 100,000 PHP

To convert that amount of Philippine pesos profit into U.S. dollars, you need to perform the following calculation:

100,000 PHP ÷ 51.00 PHP/USD = 1,960.78 USD

Alternatively, if the USD/PHP market had instead fallen to 49.00, your trading loss would be:

100,000 USD x (49.00-50.00 PHP/USD) = -100,000 PHP

Your loss converted into U.S. dollars at a USD/PHP exchange rate of 49.00 would be:

-100,000 PHP ÷ 49.00 PHP/USD = -2,040.82 USD

Making Money with Forex in the Philippines

If you can come up with a consistently profitable strategy to implement in your trading plan that you can stick to within the requirements, you should be able to make money trading forex in the Philippines.

The key element to your success consists of formulating a profitable trading strategy. Most successful trading plans include objective trading criteria, risk/reward analysis and sound money management principles. Also, keep in mind that many strategies do not make money regularly over time due to changing market conditions, even if they might work well for a while.

Best Online Forex Brokers in the Philippines

To trade currencies locally in the Philippines, you will need special authorization, a substantial sum of money

For example, international brokers like FOREX.com, IG and Interactive Brokers have been known to accept clients from the Philippines. If you meet a particular broker's requirements, you may be able to open an account and use PayPal or Skrill online payment services to fund your margin account.

Due to the questionable legality of forex trading in the Philippines, be aware that it could pose a risk to use credit cards or bank wire transfers as a margin deposit method from the Philippines. Your forex broker should advise you about that.

1 Minute Review

FOREX.com is a one-stop shop for forex traders. With a massive range of tradable currencies, low account minimums and an impressive trading platform, FOREX.com is an excellent choice for brokers searching for a home base for their currency trading. New traders and seasoned veterans alike will love FOREX.com's extensive education and research center that provides free, informative forex trading courses at multiple skill levels. While FOREX.com is impressive, remember that it isn't a standard broker.

Best For

- MetaTrader 4 users

- Beginner forex traders

- Active forex traders

Pros

- Impressive, easy-to-navigate platform

- Wide range of education and research tools

- Access to over 80 currencies to buy and sell

- Leverage available up to 50:1

Cons

- Cannot buy and sell other securities (like stocks and bonds)

Best For

International Forex/CFD Traders

Get started securely through eToro's website

Disclosure: eToro USA LLC; Investments are subject to market risk, including the possible loss of principal.

1 Minute Review

Though Australian and British traders might know eToro for its easy stock and mobile trading, the broker is now expanding into the United States with cryptocurrency trading. U.S. traders can begin buying and selling both major cryptocurrencies (like Bitcoin and Ethereum) as well as smaller names (like Tron Coin and Stellar Lumens).

eToro offers traders the opportunity to invest their assets into premade portfolios or cryptocurrencies, similar to services offered by robo-advisors through traditional brokers. Though eToro isn't a one-stop-shop for everything an investor needs, its easy-to-use platform and low spreads is a great way to enter the cryptocurrency market.

Best For

- International Forex/CFD Traders

- New cryptocurrency traders looking for an easy-to-use platform

- Traders who want to buy and sell cryptocurrencies on-the-go

Pros

- Simple platform that is easy to master

- CopyTrader feature that allows new traders to copy the same strategies used by professionals

- Virtual dummy account that gives you $100,000 to practice trades

Cons

- U.S. traders currently limited to cryptocurrencies

- Only 15 major coins available to trade

Account Minimum

AUD$200 or equivalent

1 Minute Review

Pepperstone is an Australian broker focused on providing international forex, CFD and cryptocurrency trading. Though U.S. traders currently cannot open an account with Pepperstone, the broker remains an affordable and comprehensive option for international traders.

Pepperstone offers traders access to over 61 forex markets, over 60 CFDs for index funds and stocks and 5 cryptocurrencies. Leverage options with Pepperstone are extensive; you may qualify for up to 500:1 leverage when trading currencies and up to 5:1 leverage when trading cryptocurrencies, for example.

There are a few areas where Pepperstone can afford to improve. We'd love to see Pepperstone add its own trading platform in the future instead of relying entirely on 3rd-party platforms. We'd also love to see direct stock and fund purchase options in the future. Despite these flaws, Pepperstone remains a very strong choice for international traders.

Best For

- International traders interested in trading CFDs from foreign markets and currencies

- Traders who are already familiar with the MetaTrader or cTrader platforms

- Traders who are looking for leverage when trading cryptocurrencies

Pros

- Access to over 61 forex pairs and over 60 stock CFDs

- Leverage available for both forex and cryptocurrency trading

- Wide range of educational tools and courses that both beginners and experts can use

- 24/7 customer service

Cons

- Not currently available to U.S. traders

- No option to purchase stocks, bonds or mutual funds directly; only CFDs are available

1 Minute Review

A fully regulated broker with a presence in Europe, South Africa, the Middle East, British Virgin Islands, Australia and Japan, Avatrade deals with mainly forex and CFDs on stocks, commodities, indexes, forex, cryptocurrencies, etc. This brokerage is headquartered in Dublin, Ireland and began offering its services in 2006. It offers multiple trading platforms and earns mainly through spreads.

Best For

- Beginners

- Advanced traders

- Traders looking for a well-diversified portfolio

Pros

- Controlled by regulatory agencies of multiple countries

- Choice offered in terms of trading platforms

- Support available in 14 languages and trading platforms in 20 languages

- Practice/demo account available for trying out

- Breadth of trading assets

Cons

- Does not accept customers from the U.S. as it isn't regulated in the U.S.

- Transferring funds to the account may take up to five days; withdrawals could take up to 10 days

Forex Terminology

Like many professions that have evolved their own jargon, forex traders use unique terminology you will probably want to learn before starting to trade. These include the following terms:

- Lot size: Standard lot size is 100,000 base currency units.

- Margin calls: These happen when your trading account requires more funding for you to hold your existing positions.

- Orders: Instructions given to your broker to execute transactions on your behalf. Various order types exist, such as limit, stop loss, take profit and market orders.

- Pip: Stands for point in percentage and represents the smallest amount that a currency pair's exchange rate quotation can change.

- Pound sterling: A nickname for the British pound, though it is no longer backed by silver.

- Short covering: A phenomenon whereby traders shorting a currency start buying as the price rises.

- Stop-limit order: An order placed at a higher price that allows you to profit before the currency drops once again.

- Stop-loss order: An order placed at a lower price that allows traders to avoid losses as currency prices fall.

- XAG/USD: The symbol for the silver index in U.S. dollars.

- XAU/USD: The symbol for the gold index in U.S. dollars.

- Yield: The return on your investment.

Does Trading Forex in the Philippines Make Sense?

Given the unfavorable local regulatory environment imposed by the Philippines' SEC, you might want to think twice about trading forex from the Philippines. Although some retail forex traders have been able to make margin account deposits using online payment services, you really never know when that loophole might close.

You would therefore probably be taking an extra risk by opening a forex trading account with an international broker to trade in from the Philippines. Since trading any financial market requires you to take at least some risk, that might be an additional risk you feel ready to take in order to have the opportunity to trade currencies.

If so, all you need to do is contact an international forex broker that takes clients from the Philippines and follow the necessary steps outlined above to open and fund an account with the broker you select.

Frequently Asked Questions

Is forex trading legal in the Philippines?

1

Is forex trading legal in the Philippines?

asked

Luke Jacobi

1

Forex trading is not entirely legal in the Philippines. You must use an international forex broker to make your trades.

Answer Link

answered

Benzinga

What are the best forex brokers for trading in the Philippines?

1

What are the best forex brokers for trading in the Philippines?

asked

Luke Jacobi

1

A few of the best ones for trading forex in the Philippines include City Index, XTB and Saxo Bank.

Answer Link

answered

Benzinga

Can I lose more than I invest in forex?

1

Can I lose more than I invest in forex?

asked

Luke Jacobi

1

Not usually. Your broker will not allow you to lose more than you have in your trading account. If you hold a losing position, it will simply close your account balance when it gets close to $0. In rare cases, a slippage or significant price gap may put the trader's balance into negative territory.

Answer Link

answered

Benzinga

What is margin?

1

What is margin?

asked

Luke Jacobi

1

Margin is money you need to have in the account with your broker to secure your open position. Different brokers require a different amount of margin to keep your positions open.

Answer Link

answered

Benzinga

FOREX.com, registered with the Commodity Futures Trading Commission (CFTC), lets you trade a wide range of forex markets plus spot metals with low pricing and fast, quality execution on every trade.

Best Broker for Forex Trading in Philippines

Source: https://www.benzinga.com/money/forex-trading-philippines/

0 Response to "Best Broker for Forex Trading in Philippines"

Post a Comment